Liability accounts usually have the word “payable” in their name—accounts payable, wages payable, invoices payable. “Unearned revenues” are another kind of liability account—usually cash payments that your company has received before services are delivered. The general ledger provides a comprehensive view of your financial activities. However, a profit and loss (P&L) statement overviews revenues and expenses. But the final structure and look will depend on the type of business and its size.

- COA stands for chart of accounts, which is a systematic arrangement of all the account titles and numbers a business uses for its accounting system.

- Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website.

- Expenses are typically found on the income statement alongside revenue.

- Organizations began creating their own lists, called charts of accounts, to categorize and organize their financial transactions systematically.

- For example, a taxi business will include certain accounts that are specific to the taxi business, in addition to the general accounts that are common to all businesses.

- These can include cash, inventory, equipment, buildings, and investments.

Get to Know ASU 2023-08, FASB’s Crypto Accounting Update

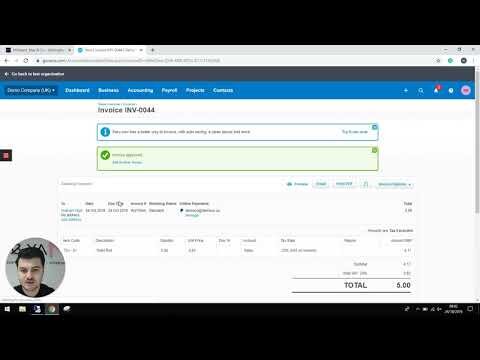

In accounting, each transaction you record is categorized according to its account and subaccount to help keep your books organized. These accounts and subaccounts are located in the COA, along with their balances. Your accounting software should come with a standard COA, but it’s up to you and your bookkeeper or accountant to keep it organized. Here are tips for how to do this, plus details about what a COA is, examples of a COA and more. Kristen Slavin is a CPA with 16 years of experience, specializing in accounting, bookkeeping, and tax services for small businesses.

Chart of accounts structure

Small businesses may record hundreds or even thousands of transactions each year. A chart of accounts (COA) is a comprehensive catalog of accounts you can use to categorize those transactions. Think of it as a filing cabinet for your business’s accounting system. Ultimately, it helps you make sense of a large pool of data and understand your business’s financial history. Because the chart of accounts is a list of every account found in the business’s accounting system, it can provide insight into all of the different financial transactions that take place within the company. It helps to categorize all transactions, working as a simple, at-a-glance reference point.

Income Statement Accounts

The expenses can be tied back to specific products or revenue-generating activities of the business. Each of the accounts in the chart of accounts corresponds to the two main financial statements, i.e., the balance sheet and income statement. A chart of accounts, or COA, is a list of all your company’s accounts, together in one place, that is a part of your business’s general ledger.

Transform your Record-to-Report processes with HighRadius!

Liabilities include accounts payable, loans, credit card debt, and other expenses that need to be paid. Whenever you record a business transaction—whether it’s taking out a new bank loan, receiving an invoice from a client, or buying a new laptop for the office—you need to log it into the correct account. These standards provide guidelines for financial reporting, including the structure of the COA. The advent of computers in the latter half of the 20th century changed accounting practices.

As we said before, an effective COA begins with two essential building blocks – balance sheet accounts and income statement accounts. The relationship between journal entries and the chart of accounts is akin to the relationship between a script and its cast of characters. The COA serves as the cast—a structured list of all accounts where financial transactions can be recorded.

Would you prefer to work with a financial professional remotely or in-person?

- Second, let’s see how the journal entries feed into the general ledger which feeds into the trial balance.

- Daniel Liberto is a journalist with over 10 years of experience working with publications such as the Financial Times, The Independent, and Investors Chronicle.

- Non-current assets are things a company owns but won’t convert to cash shortly, like property, equipment, and long-term investments.

- The chart of accounts helps you organize your transactions into a convenient view of how the money moves through your business.

The accounting software then aggregates the information into an entity’s financial statements. Second, a well-organised chart of accounts helps you stay on top of compliance and reporting. Whether you’re preparing for tax season or creating financial reports for stakeholders, having all your accounts clearly laid out makes the process much smoother and less stressful. So, separating chart of accounts examples these additional accounts allows businesses to understand the specific drivers of their financial performance in more detail. Other Comprehensive Income includes gains and losses that have not yet been realized but are included in shareholders’ equity. Separating Other Comprehensive Income allows businesses to track changes in the value of certain assets or liabilities over time.

- To make it easy for readers to locate specific accounts or to know what they’re looking at instantly, each COA typically contains identification codes, names, and brief descriptions for accounts.

- Identifying which locations, events, items, or services bring in the most cash flow is key to better financial management.

- Therefore, a well-formed and organized COA allows you to draw a direct line between a transaction and how it flows into your financial statements.

- This list includes every category under which you can classify money spent or earned by your business, from the salaries paid to employees to the revenue from sales.

- He has experience as an editor for Investopedia and has worked with the likes of the Consumer Bankers Association and National Venture Capital Association.

Drive Business Performance With Datarails

The structure of a COA can be customized to fit the specific needs of a business. While smaller businesses may have a simpler, less detailed COA, larger enterprises might require a more complex and detailed structure to accommodate various departments, projects, or locations. The accounts are identified with unique account numbers, and are usually grouped according to their financial statement classification. Our partners cannot pay us to guarantee favorable reviews of their products or services.

Why is chart of accounts important for efficient finance management?

Equity represents the value that is left in the business after deducting all the liabilities from the assets. Owner’s equity measures how valuable the company is to the shareholders of the company. This way you can compare the performance of different accounts over time, providing valuable insight into how you are managing your business’s finances. That doesn’t mean recording every single detail about every single transaction. You don’t need a separate account for every product you sell, and you don’t need a separate account for each utility. An expense account balance, for example, shows how much money has been spent to operate your business, whereas a liabilities account balance shows how much money your business still owes.