Content

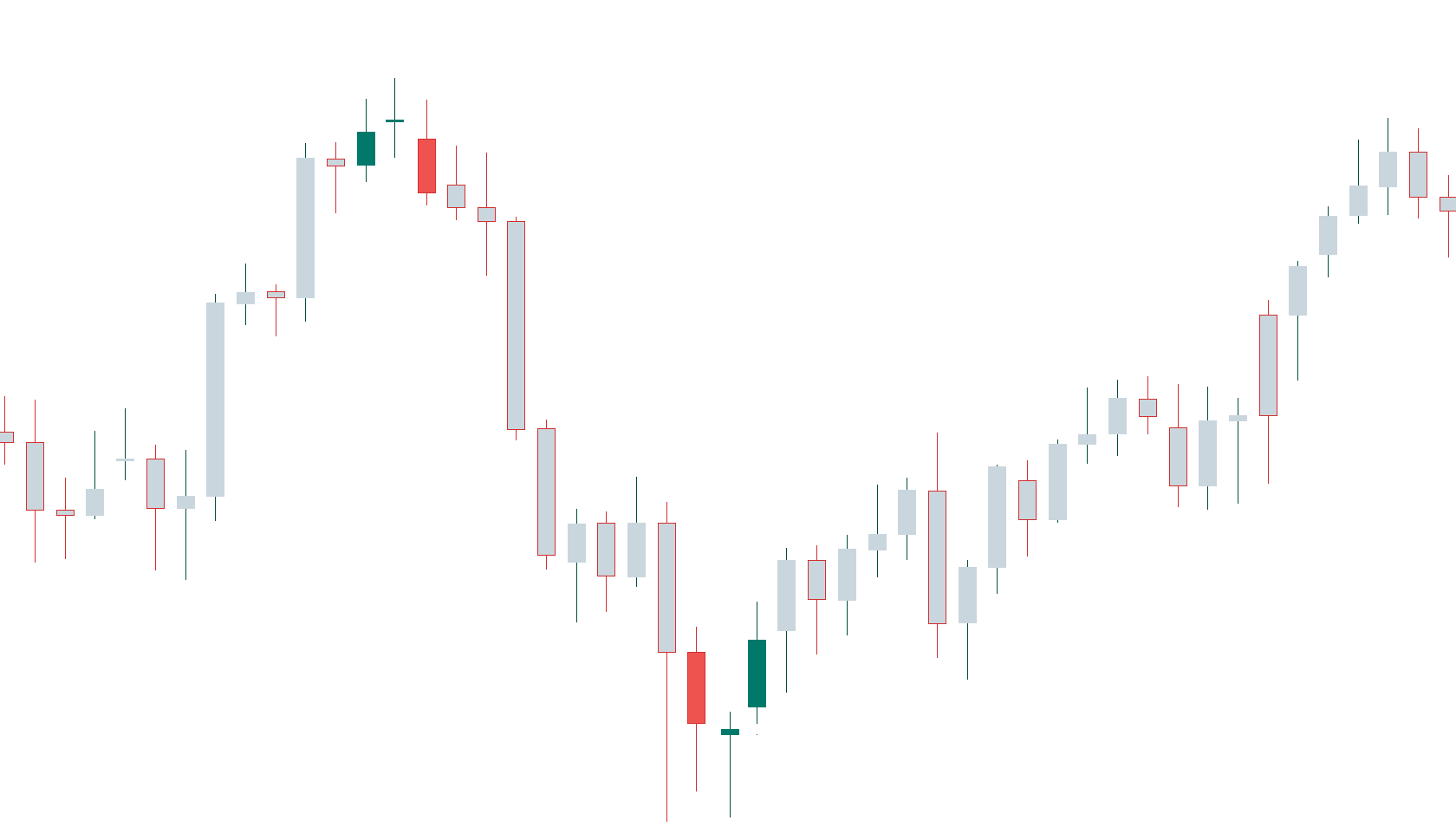

After the semiconductor index fell by about 30% in 2022, it has bounced strongly in 2023, up about 37% year-to-date. It specializes in photolithography equipment, where light sources are used to photo-reactively create patterns on wafers that become printed circuits. ASML is the dominant leader across all types of lithography but, most importantly, is the only company selling equipment for extreme ultra-violet (EUV) lithography, the latest generation technology.

- The results of that belt-tightening seem to have impressed analysts.

- The company has created a dominant market position in the search market and continues to gain market share in the cloud market with its Google Cloud business.

- Moreover, the artificial intelligence chip industry is predicted to reach $127.8 billion by 2028, with a 42.3% CAGR.

- Although AMD is still far smaller than Intel, it has been picking up serious market share in both the data center and personal computing space.

So, when one or all of these customers face troubles, it can spell trouble for KLA too. Though Taiwan Semiconductor (TSM) and Advanced Micro Devices (AMD) are still growing, for example, Nvidia’s (NVDA) sales were flat in the most recent quarter. Revenue and GAAP earnings were up 6.6% and 4.1% year-over-year, respectively.

True, inventory issues remain a near-term issue for SiTime, but expectations are for demand to return in the second half of this year, says Needham analyst N. SiTime (SITM, $108.47) makes silicon-based timing products for use in electronic equipment, from mobile phones to graphics and identity cards. The A800 has the same processing power of its flagship A100 chip, but has a narrower interconnect bandwidth to receive data from other chips, which is critical for AI applications. Specifically, while the A100 can send data at 600 gigabytes per second, the A800 can only transmit data at 400 gigabytes per second.

US Tech Stocks That Will Survive the Metal Export Ban From China

The fortunes of the company declined during the 2000s, and it entered Chapter 11 bankruptcy in 2018; many Sears shareholders lost the money they invested in the company. Most blue chip stocks supply their investors with consistent dividends without slippage, thus becoming a great addition to every investor’s portfolio. Profitability and dividend yields for some blue chips, such as, for example, Vodafone or Shell, are sometimes near historical highest values. High dividend yields vary in percentage, but some of them can offer a solid figure of around 15%. Long-term investors own blue chip stocks because of their wide moats, dependable dividends and steady earnings.

Geographically, it derives a majority of revenue from Europe and also has a presence in the United States; China; Japan; South Korea, and other countries. For example, if you own $1,000 shares of KO stock in June 2022, you would be in line to collect $5,520 in annual dividends. https://g-markets.net/helpful-articles/what-is-spread-in-forex-trading-and-why-does-it/ By reinvesting those dividends you would buy 22.66 new shares without having had to add any of your own money. Street expects its revenue to increase by 2.9% year-over-year to $892.50 million in 2024. Its EPS is expected to grow by 19.4% year-over-year to $1.97 in 2024.

Its forward non-GAAP P/E multiple of 10.80 is 47.3% lower than the industry average of 20.47. The Biden-Harris Administration has announced the first CHIPS for America funding opportunity to reinvigorate the domestic semiconductor industry. The Bipartisan CHIPS and Science Act includes $39 billion in semiconductor incentives.

As with all investments, there are pros and cons to investing in blue chip stocks. Blue-chip stocks have many attractive qualities but are not suitable for all investment accounts, strategies or investors. Blue-chip tech stocks don’t perform the same as blue-chip materials stocks or blue-chip consumer staples. But if you’re still not convinced, here are a couple of additional reasons why blue chip stocks have a place in every portfolio. Cisco Systems is the second tech stock on our list of blue-chip stocks for the long term.

Are Blue Chips Good Investments?

The reported revenue of $2.43 billion came in above the midpoint of KLA’s guidance range of $2.20 billion-$2.50 billion. I also included chipmakers that offer some grist for stock pickers who like to look below the surface for opportunities. Never has the sector been more competitive, with more than 750 companies vying globally to build the insides of the next hot device or power future megacomputers. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services.

Blue chip stocks, being a safer investment, are especially attractive for investors near retirement. The market cap continues to grow because this blue chip stock provides popular media and video streaming services through its online library of movies, TV series, documentaries, and other content. The company isn’t shy about investing in its business and using that investment to grow into new areas to build the company’s market value to investors’ benefit. Another blue chip downside is relatively high share prices, which make these stocks less accessible to people who don’t have a lot of money to invest. Microchip Technology is trading at a one-year forward earnings multiple of 14x, below its five-year median of 17x, and below the industry average of 18x.

Taiwan Semiconductor Manufacturing

The company operates in two segments, Semiconductor Solutions, and Infrastructure Software. Lincoln National Corporation offers life insurance, annuities, retirement plan services and group protection. The corporation was founded in 1905 as The Lincoln National Life Insurance Company.

The 30 companies that make up the Dow Jones Industrial Average are acknowledged by virtually everyone as blue chips. Conversely, more conservative investors need not stick to fixed income, low growth assets. Buying blue chip stocks can offer the opportunity for capital gains that may, in many cases, outpace the rate of inflation which is a concern with fixed-income investments. And since many blue chip stocks pay dividends and rising dividends at that, investors have another avenue for collecting income from these high-quality stocks. Whether held individually or as part of a fund, blue chip stocks should be part of every investor’s portfolio.

Best Penny Stocks on Robinhood To Invest In for 2023

While the value of blue chip stocks tends to be stable, every company has ups and downs, and no one is immune to market forces. Just like any stocks, shares can lose value, and dividend payments can fall if the company’s profits do. Blue-chip stocks offer stability, safety and dividends through companies with well-entrenched businesses that have proven they can stand the test of time (and pay dividends while doing it). Blue-chip stocks also tend to be substantial businesses, large or mega caps, with deep moats related to their brands, product(s) or industries. They offer an element of safety and income for investors in the long haul. Among the many benefits is reduced volatility and, in many cases, market-beating dividend yields.

The truth is that over the years, there’s a case to be made for both. Rashmi is passionate about capital markets, wealth management, and financial regulatory issues, which led her to pursue a career as an investment analyst. With a master’s degree in commerce, she aspires to make complex financial matters understandable for individual investors and help them make appropriate investment decisions. Yet, they’re not immune to market downturns and economic upheaval. That’s something all investors considering blue chips should bear in mind. Blue chips are considered safe investments due to their longstanding financial stability.

How Do You Invest in Blue Chips?

Earnings expectations have been revised higher by as much as 11%. Benzinga has picked the best online brokers to get you started on your investment journey. If you’re an active day trader, you can also check out the daily updates on stocks under , stocks under and stocks under .

- The Coca-Cola Company has paid dividends to investors for over 120 years, since 1893.

- The semiconductor industry, like most of the technology sector, was hit hard during the chip shortage of 2022, but it has bounced back strongly in 2023.

- Add to that the prevalent negative economic sentiment due to the Fed hiking interest rates.

- Trading 35% below our fair value estimate of $60, Comcast is the most undervalued stock on our list of blue-chip stocks to buy.

- Micron Technology Inc. has been producing memory and storage solutions for over 40 years.

- While a blue chip company’s utter failure may not be common, these stocks are still subject to price fluctuation.

The markets that use the company’s products include those in the appliances, electronics, beverage, construction and food industries. Lastly, the Morningstar Capital Allocation Rating is an assessment of how well a company manages its balance sheet investments and shareholders’ distributions. Analysts assign each company one of three ratings—exemplary, standard, or poor—based on their assessments of how well a management team provides shareholder returns. Pharmaceutical company AbbVie Inc is a blue chip stock, although its shares have performed poorly in 2023 so far.

Investors’ interest in chip stocks is evident from the SPDR S&P Semiconductor ETF (XSD) 24% returns over the past six months. The global semiconductor market is expected to grow at a 13.1% CAGR until 2032. Investors’ interest in chip stocks is evident from the VanEck Vectors Semiconductor ETF’s (SMH) 23.7% returns over the past three months and 33.2% over the past six months. Blue chip stocks are the titans of their sectors—industry-defining companies that are well-known, well-capitalized, long-term stable plays with solid financial prospects.

Click here to instantly download your free spreadsheet of all 350+ Blue Chip Stocks now, along with important investing metrics. We’d like to share more about how we work and what drives our day-to-day business. Morningstar Investor’s stock ratings, analysis, and insights are all backed by our transparent, meticulous methodology. It currently trades significantly lower than its all-time high from November 2021. Sports giant Nike has shown tremendous growth for many years, fighting its way to the top of the market since going public in 1980.

Within a portfolio’s allocation to stocks, an investor should consider owning mid-caps and small-caps as well. The Morningstar Style Box, meanwhile, is a nine-square grid that provides a graphical representation of the investment style of stocks, bonds, or funds. A stock is also classified as either small-cap, mid-cap, or large-cap based on its market capitalization. Rounding out our list of the best blue-chip stocks to buy for the long term, Honeywell is a global multi-industrial behemoth. The company wears the blue-chip title with ease, as it traces its roots back to 1885, producing a predecessor to the modern thermostat, explains Morningstar senior analyst Josh Aguilar.

It seeks to match the performance of the ICE Semiconductor Index, before fees and expenses. Because it’s passively managed, it may provide some protection from volatility compared to buying a single stock. Texas Instruments is a longtime tech titan, having been founded in 1930. The company designs and manufactures analog and embedded semiconductors.

However, the chip giant is quietly helping to power everything from 5G mobile network development to data centers and industrial equipment. As its name suggests, it supplies a broad range of communications parts and components that companies need across many sectors of the economy. Another reason these stocks are a great investment is that they require little oversight. You can buy and hold them passively without having to manage them actively. ETFs will have a much lower expense ratio than mutual funds holding the same stocks because ETFs are more passive while mutual funds are more actively managed. The service offers a discounted rate for the first year and has a 30-day membership refund period.